Accident insurance help serves as an essential safety net for families facing unforeseen events, covering unexpected medical expenses and related costs like vehicle repairs. This support eases financial strain during recovery, allowing families to focus on healing and rebuilding their lives without added stress, ensuring a smoother path towards physical and emotional restoration.

Accident insurance is a crucial safety net for families facing unforeseen events. In moments of crisis, this coverage steps in to support recovery by providing financial security and essential assistance. Understanding how accident insurance helps can make all the difference in navigating challenging situations. This article guides you through the impact of accident insurance on family recovery, offers insights into choosing the right coverage, and highlights why it’s an important consideration for every household.

- Understanding Accident Insurance: A Safety Net for Unforeseen Events

- The Impact on Family Recovery: How Accident Insurance Provides Support

- Choosing the Right Coverage: Navigating Options to Ensure Comprehensive Protection

Understanding Accident Insurance: A Safety Net for Unforeseen Events

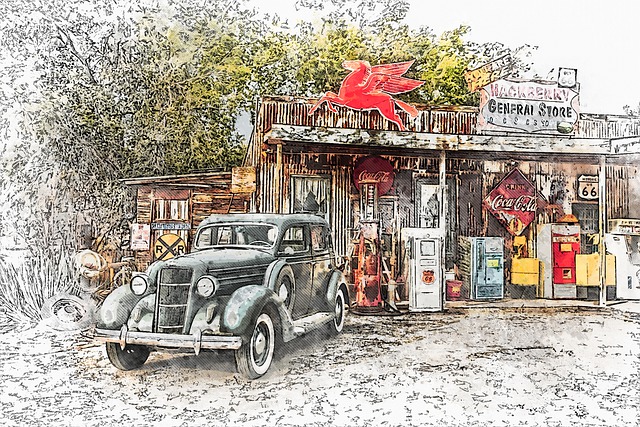

Accident insurance help acts as a safety net for families caught in unforeseen events. It provides financial support during an already stressful time, helping to cover unexpected medical expenses and other related costs that can arise from accidents. This coverage is especially crucial when dealing with serious incidents involving personal injury or property damage, such as car crashes or home accidents.

Having accident insurance ensures that families can access the necessary resources for recovery without the added financial burden. For instance, a vehicle body shop visit due to auto bodywork repairs after an accident becomes more manageable with insurance coverage. Even seemingly minor issues like car scratch repair are covered, contributing to the overall peace of mind and faster recovery process for affected individuals and their families.

The Impact on Family Recovery: How Accident Insurance Provides Support

When a family member is involved in an accident, the immediate impact can be devastating, both physically and emotionally. This is where accident insurance help plays a crucial role in supporting their recovery process. Beyond covering medical expenses, which are often substantial, this type of insurance provides financial stability during a time when families may struggle to maintain their regular routines and income streams.

Having access to resources for things like vehicle dent repair or auto dent repair, while seemingly minor, can alleviate additional stress during an already turbulent period. Moreover, with accident insurance help, families can focus on healing and rehabilitation without the constant worry of mounting bills and financial strain. This support system enables them to navigate the challenges ahead, ensuring a smoother path to recovery and a chance to rebuild their lives, both physically and financially.

Choosing the Right Coverage: Navigating Options to Ensure Comprehensive Protection

Choosing the right accident insurance help is a crucial step in ensuring your family’s recovery after a mishap. With various coverage options available, understanding what suits your needs best is essential. Start by evaluating the potential risks and costs associated with car accidents, especially regarding collision damage. This might include expenses for car bodywork repairs, car paint repair, or even a complete overhaul at a trusted collision repair center.

Consider factors like your vehicle’s age, make, and model, as well as the average cost of repairs in your area. Opting for comprehensive coverage can provide peace of mind by covering not just the financial burden but also ensuring access to quality services. Remember, the goal is to choose a policy that offers sufficient protection while aligning with your budget.

Accident insurance help is invaluable in facilitating family recovery from unexpected events. By providing financial support during challenging times, it ensures that families can focus on healing and rebuilding without the added burden of economic stress. When choosing coverage, understanding various options allows individuals to secure comprehensive protection tailored to their needs, offering peace of mind and the resources necessary for a smoother recovery process.